Quick Examples

This section demonstrates how to perform stream processing tasks through two quick examples.

Example 1. Bid-Ask Spread

This first example explores real-time stream processing through calculating the bid-ask spread based on stock quote data.

Calculation Logic

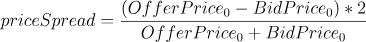

The bid-ask spread is defined as the difference between the best offer price (offerPrice0) and best bid price (bidPrice0) divided by the average price, with the formula as follows:

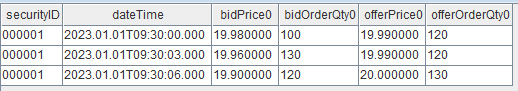

An example of the input data is as shown below.

Implementation

(1) Create a shared stream table tick as the publishing table:

share(table=streamTable(1:0, `securityID`dateTime`bidPrice0`bidOrderQty0`offerPrice0`offerOrderQty0, [SYMBOL,TIMESTAMP,DOUBLE,LONG,DOUBLE,LONG]), sharedName=`tick)(2) Create a shared stream table resultTable to store calculation results:

share(table=streamTable(1:0, ["securityID", "dateTime", "factor"], [SYMBOL, TIMESTAMP, DOUBLE]), sharedName=`resultTable)Subsequent calculation results will be written to this table in real time.

(3) Define the factor calculation function factorCalFunc to

compute the bid-ask spread factor for each stock:

def factorCalFunc(msg){

tmp = select securityID, dateTime, (offerPrice0-bidPrice0)*2\(offerPrice0+bidPrice0) as factor from msg

objByName("resultTable").append!(tmp)

}- msg is an in-memory table with the same schema as the tick table.

objByName("resultTable").append!(tmp)appends the calculation results in the temporary table tmp to the result table resultTable.- The temporary table tmp is generated using DolphinDB SQL statements. The

formula

(offerPrice0-bidPrice0)*2/(offerPrice0+bidPrice0)calculates the bid-ask spread factor for each row in the msg table.

(4) Subscribe to the stream table tick and specify the computation logic:

subscribeTable(tableName="tick", actionName="factorCal", offset=-1, handler=factorCalFunc, msgAsTable=true, batchSize=1, throttle=0.001)The subscription task processes incoming data with UDF

factorCalFunc (where bid-ask spread is defined) and outputs

results to resultTable each time new record is inserted into the tick table.

tableName="tick"indicates that the subscription is for the stream table tick.actionName="factorCal"specifies a unique name for the subscription task.offset=-1means processing starts from the first arrived message after subscription.handler=factorCalFuncspecifies that thefactorCalFuncfunction is used to process the data.msgAsTable=trueindicates that the subscribed data is input as a table to the functionfactorCalFunc.batchSize=1control the processing frequency, triggering computation whenever a new record arrives.

(5) Then inject simulated data to the stream table tick to observe the processing results:

insert into tick values(`000001, 2023.01.01T09:30:00.000, 19.98, 100, 19.99, 120)

insert into tick values(`000001, 2023.01.01T09:30:03.000, 19.96, 130, 19.99, 120)

insert into tick values(`000001, 2023.01.01T09:30:06.000, 19.90, 120, 20.00, 130)After inserting these rows into the tick table, the resultTable will automatically update with the computed factor values.

Example 2. Active Buy Volume Ratio

This example demonstrates stateful processing by calculating the active buy volume ratio over the past n minutes based on tick trade data. Unlike the bid-ask spread calculation processes individual records, the active buy volume ratio requires historical context.

Calculation Logic

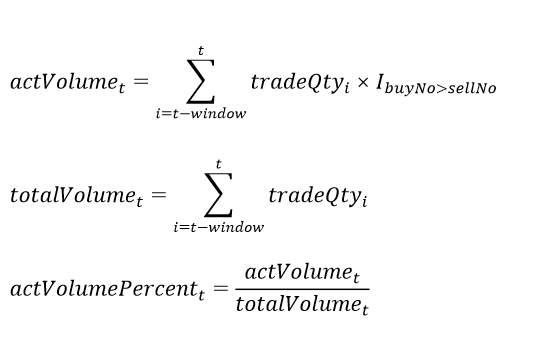

The active buy volume ratio is the ratio of active buy volume to total trade volume, calculated as follows:

where actVolumet represents the active buy volume within the interval from t-window to t, and totalVolumet represents the total trade volume within the same interval.

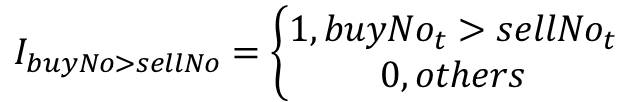

The signal function I is defined as follows:

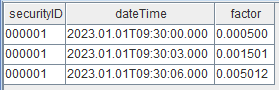

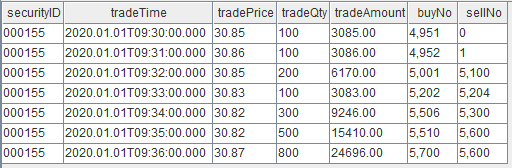

An example of the input data is as shown below.

Implementation

(1) Create a shared stream table trade as the publishing table:

share(table=streamTable(1:0, `securityID`tradeTime`tradePrice`tradeQty`tradeAmount`buyNo`sellNo, [SYMBOL,TIMESTAMP,DOUBLE,INT,DOUBLE,LONG,LONG]), sharedName=`trade)(2) Create a shared stream table resultTable to store calculation results:

share(table=streamTable(1:0, ["securityID", "tradeTime", "factor"], [SYMBOL, TIMESTAMP, DOUBLE]), sharedName=`resultTable) Subsequent calculation results will be written to this table in real time.

(3) Define the factor calculation function.

The active buy volume ratio is calculated by looking back over a 5-minute window based on the current record and aggregating data within that window. As the input streams continue to grow, the window slides forward in real time. Different from the bid-ask spread calculation, this case requires both the latest input record and historical data within a certain timeframe. This section first introduces an incorrect implementation to illustrate potential issues with stateless calculations, followed by the correct approach.

Incorrect Implementation

Define a function factorVolumeCalFunc:

def factorVolumeCalFunc (msg){

tmp = select securityID, tradeTime, tmsum(tradeTime, iif(buyNo>sellNo, tradeQty, 0), 5m)\tmsum(tradeTime, tradeQty, 5m) as factor from msg context by securityID

objByName("resultTable").append!(tmp)

}

subscribeTable(tableName="trade", actionName="factorCal", offset=-1, handler=factorVolumeCalFunc , msgAsTable=true, batchSize=1, throttle=0.001)- msg is an in-memory table with the same schema as the tick table.

objByName("resultTable").append!(tmp)appends the calculation results in the temporary table tmp to the result table resultTable.- The temporary table tmp is generated using DolphinDB SQL statements:

context by securityIDgroups msg by securityID.tmsum(tradeTime, tradeQty, 5m)computes the trading volume in the past 5 minutes based on the tradeTime column.tmsum(tradeTime, iif(buyNo>sellNo, tradeQty, 0), 5m)computes the active trading volume for records (with buyNo>sellNo) in the past 5 minutes.

We use simulated data to observe the results:

share(table=streamTable(10000:0, ["securityID", "tradeTime", "factor"], [SYMBOL, TIMESTAMP, DOUBLE]), sharedName=`resultTable)

// Ingest simulated data

input1 = table(1:0, `securityID`tradeTime`tradePrice`tradeQty`tradeAmount`buyNo`sellNo, [SYMBOL,TIMESTAMP,DOUBLE,INT,DOUBLE,LONG,LONG])

insert into input1 values(`000155, 2020.01.01T09:30:00.000, 30.85, 100, 3085, 4951, 0)

insert into input1 values(`000155, 2020.01.01T09:31:00.000, 30.86, 100, 3086, 4952, 1)

insert into input1 values(`000155, 2020.01.01T09:32:00.000, 30.85, 200, 6170, 5001, 5100)

insert into input1 values(`000155, 2020.01.01T09:33:00.000, 30.83, 100, 3083, 5202, 5204)

insert into input1 values(`000155, 2020.01.01T09:34:00.000, 30.82, 300, 9246, 5506, 5300)

insert into input1 values(`000155, 2020.01.01T09:35:00.000, 30.82, 500, 15410, 5510, 5600)

// Call factorVolumeCalFunc

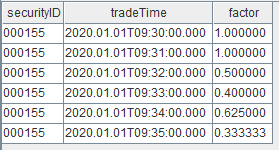

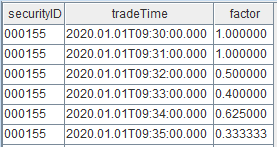

factorVolumeCalFunc(msg=input1)Check resultTable:

select * from resultTable

Then ingest another record and call the function again:

input2 = table(1:0, `securityID`tradeTime`tradePrice`tradeQty`tradeAmount`buyNo`sellNo, [SYMBOL,TIMESTAMP,DOUBLE,INT,DOUBLE,LONG,LONG])

insert into input2 values(`000155, 2020.01.01T09:36:00.000, 30.87, 800, 24696, 5700, 5600)

factorVolumeCalFunc (msg=input2)The latest result is incorrect.

This approach calculates based only on new records in the trade table without caching or retrieving necessary historical data, leading to incorrect results.

Correct Implementation

createReactiveStateEngine(name="reactiveDemo", metrics=<[tradeTime, tmsum(tradeTime, iif(buyNo>sellNo, tradeQty, 0), 5m)\tmsum(tradeTime, tradeQty, 5m)]>, dummyTable=trade, outputTable=resultTable, keyColumn="securityID")

def factorVolumeCalFunc (msg){

getStreamEngine("reactiveDemo").append!(msg)

}name="reactiveDemo"specifies the unique name for the engine.dummyTable=tradespecifies that the input table schema matches the trade table.outputTable=resultTableindicates the results will be output to resultTable.keyColumn="securityID"groups data by securityID. Each group maintains its state independently.- metrics defines the calculation logic, where

- tradeTime outputs the tradeTime column from input data.

tmsum(tradeTime, iif(buyNo > sellNo, tradeQty, 0), 5m)computes active trading volume over the past 5 minutes.tmsum(tradeTime, tradeQty, 5m)computes total trading volume over the past 5 minutes.

In the reactive state engine, moving functions like tmsum are

incrementally computed based on previous results, caching necessary states for

efficiency. For example, the total trade volume can be updated following the

incremental computation logic: Total Volume(t) = Total Volume(t-1) + Current

Volume - Expired Volume.

(4) Subscribe to the table trade to ingest the data to a reactive state engine.

The metrics of the engine define how to calculate active buy volume ratio with

tmsum function (which is incrementally optimized within the

engine).

createReactiveStateEngine(name="reactiveDemo", metrics=<[tradeTime, tmsum(tradeTime, iif(buyNo>sellNo, tradeQty, 0), 5m)\tmsum(tradeTime, tradeQty, 5m)]>, dummyTable=trade, outputTable=resultTable, keyColumn="securityID")

subscribeTable(tableName="trade", actionName="factorCal", offset=-1, handler=getStreamEngine("reactiveDemo"), msgAsTable=true, batchSize=1, throttle=0.001)insert into trade values(`000155, 2020.01.01T09:30:00.000, 30.85, 100, 3085, 4951, 0)

insert into trade values(`000155, 2020.01.01T09:31:00.000, 30.86, 100, 3086, 4952, 1)

insert into trade values(`000155, 2020.01.01T09:32:00.000, 30.85, 200, 6170, 5001, 5100)

insert into trade values(`000155, 2020.01.01T09:33:00.000, 30.83, 100, 3083, 5202, 5204)

insert into trade values(`000155, 2020.01.01T09:34:00.000, 30.82, 300, 9246, 5506, 5300)

insert into trade values(`000155, 2020.01.01T09:35:00.000, 30.82, 500, 15410, 5510, 5600)Check resultTable:

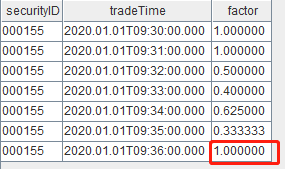

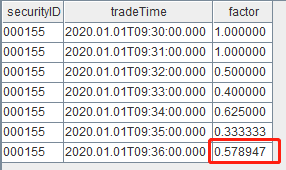

Then ingest another record:

insert into trade values(`000155, 2020.01.01T09:36:00.000, 30.87, 800, 24696, 5700, 5600)The result for 09:36:00 is as expected.

Environment Cleanup

Users can clean up the stream processing environment by canceling subscriptions, releasing streaming engines, and deleting stream tables.

Cancel Subscriptions

Use the unsubscribeTable function to cancel a specific

subscription:

unsubscribeTable(tableName="trade", actionName="factorCal")Release Streaming Engines

Use the dropStreamEngine function to release the streaming

engine and free the memory:

dropStreamEngine(`reactiveDemo)Delete Stream Tables

Use the undef function to delete shared stream tables:

dropStreamTable(`trade)Appendix: Full Scripts

Example 1.

// Create input stream table

share(table=streamTable(1:0, `securityID`dateTime`bidPrice0`bidOrderQty0`offerPrice0`offerOrderQty0, [SYMBOL,TIMESTAMP,DOUBLE,LONG,DOUBLE,LONG]), sharedName=`tick)

// Create output stream table

share(table=streamTable(1:0, ["securityID", "dateTime", "factor"], [SYMBOL, TIMESTAMP, DOUBLE]), sharedName=`resultTable)

go

// Define processing function

def factorCalFunc(msg){

tmp = select securityID, dateTime, (offerPrice0-bidPrice0)*2\(offerPrice0+bidPrice0) as factor from msg

objByName("resultTable").append!(tmp)

}

// Subscribe to the table tick

subscribeTable(tableName="tick", actionName="factorCal", offset=-1, handler=factorCalFunc, msgAsTable=true, batchSize=1, throttle=0.001)

go

// Simulate data ingestion

insert into tick values(`000001, 2023.01.01T09:30:00.000, 19.98, 100, 19.99, 120)

insert into tick values(`000001, 2023.01.01T09:30:03.000, 19.96, 130, 19.99, 120)

insert into tick values(`000001, 2023.01.01T09:30:06.000, 19.90, 120, 20.00, 130)Example 2.

// Create input stream table

share(table=streamTable(1:0, `securityID`tradeTime`tradePrice`tradeQty`tradeAmount`buyNo`sellNo, [SYMBOL,TIMESTAMP,DOUBLE,INT,DOUBLE,LONG,LONG]), sharedName=`trade)

// Create output stream table

share(table=streamTable(1:0, ["securityID", "tradeTime", "factor"], [SYMBOL, TIMESTAMP, DOUBLE]), sharedName=`resultTable)

go

// Create a reactive state engine

createReactiveStateEngine(name="reactiveDemo", metrics=<[tradeTime, tmsum(tradeTime, iif(buyNo>sellNo, tradeQty, 0), 5m)\tmsum(tradeTime, tradeQty, 5m)]>, dummyTable=trade, outputTable=resultTable, keyColumn="securityID")

// Subscribe to table trade

subscribeTable(tableName="trade", actionName="factorCal", offset=-1, handler=getStreamEngine("reactiveDemo"), msgAsTable=true, batchSize=1, throttle=0.001)

go

// Simulate data ingestion

insert into trade values(`000155, 2020.01.01T09:30:00.000, 30.85, 100, 3085, 4951, 0)

insert into trade values(`000155, 2020.01.01T09:31:00.000, 30.86, 100, 3086, 4952, 1)

insert into trade values(`000155, 2020.01.01T09:32:00.000, 30.85, 200, 6170, 5001, 5100)

insert into trade values(`000155, 2020.01.01T09:33:00.000, 30.83, 100, 3083, 5202, 5204)

insert into trade values(`000155, 2020.01.01T09:34:00.000, 30.82, 300, 9246, 5506, 5300)

insert into trade values(`000155, 2020.01.01T09:35:00.000, 30.82, 500, 15410, 5510, 5600)

insert into trade values(`000155, 2020.01.01T09:36:00.000, 30.87, 800, 24696, 5700, 5600)