Empyrical Module for Risk and Performance Metrics

The Empyrical library is an open-source Python library developed by Quantopian, specifically designed for calculating commonly used financial risk and performance attribution metrics. It includes a variety of tools for strategy backtesting analysis and can be used to compute metrics such as annualized return, maximum drawdown, alpha, beta, Calmar ratio, Omega ratio, and Sharpe ratio. To facilitate the calculation of these metrics in DolphinDB, we have implemented the metric functions from the Empyrical library using DolphinDB scripts and encapsulated them in the DolphinDB Empyrical module.

1. Naming and Parameter Conventions

All function names in the Empyrical module follow the convention of using the

specific function's purpose as its name, such as simpleReturns,

cumReturns, cumMaxDrawdown,

calmarRatio, sharpeRatio,

rollSharpeRatio, alpha, etc.

All fields involved in this tutorial are as follows:

| Parameter / Field | Description |

|---|---|

| prices | Closing prices |

| returns | Daily simple (non-cumulative) returns |

| factorReturns | Benchmark returns / factor returns for comparison |

| factorLoadings | Factor loadings |

Note:

- In the

perfAttribfunction, factorReturns refers to the factor returns of different factors and is input as a multi-column table. - The returns parameter also accepts a benchmark return vector as the input.

- Since the

betafunction conflicts with a built-in function in DolphinDB, the corresponding function in Empyrical is namedcovarBeta(as Empyrical calculates beta using covariance / variance, whereas DolphinDB’sbetarefers to the least squares estimate of Y regressed on X). - In DolphinDB, the

maxDrawdownfunction calculates the maximum difference from a peak. In the Empyrical library, the function is defined as the cumulative maximum relative drawdown. Due to the naming conflict, the function that calculates maximum drawdown in Empyrical is namedcumMaxDrawdown. - The function

valueAtRiskhas the same meaning in both DolphinDB and Empyrical. In the Empyrical library, we use the historical simulation method to compute Value at Risk. Due to the naming conflict, the corresponding function in Empyrical is namedhisValueAtRisk.

2. Usage Examples

This chapter introduces the usage of Empyrical module, including environment setup, data preparation and function calls.

2.1 Environment Setup

Place the attached Empyrical.dos file in the [home]/modules

directory. The [home] directory is set by the system configuration

parameter home, which can be viewed using the

getHomeDir() function.

For details on module usage, see Tutorial > Modules.

2.2 Direct Function Call

Call the sharpeRatio function on a vector:

use Empyrical

ret = 0.072 0.0697 0.08 0.74 1.49 0.9 0.26 0.9 0.35 0.63

x = sharpeRatio(ret);2.3 Grouped Calculation in SQL Statements

To perform grouped calculations, we can call the function in the SQL statement.

For example, the table t contains data for 2 stocks:

close = 7.2 6.97 7.08 6.74 6.49 5.9 6.26 5.9 5.35 5.63 3.81 3.935 4.04 3.74 3.7 3.33 3.64 3.31 2.69 2.72

date = (2023.03.02 + 0..4 join 7..11).take(20)

symbol = take(`F,10) join take(`GPRO,10)

t = table(symbol, date, close)Calculate the return for each stock:

update t set ret = simpleReturns(close) context by symbol2.4 Functions With Multiple Returns

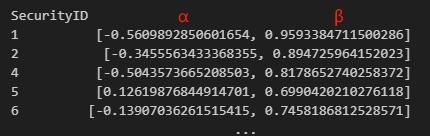

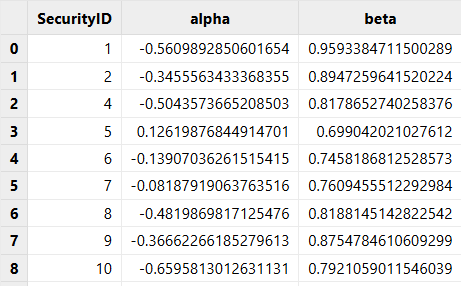

Functions such as alphaBeta return multiple columns of results.

For example:

use Empyrical

ret = 0.072 0.0697 0.08 0.74 1.49 0.9 0.26 0.9 0.35 0.63

factorret = 0.702 0.97 0.708 1.74 0.49 0.09 1.26 0.59 1.35 0.063

alpha, beta = alphaBeta(ret, factorret);Use in a SQL statement:

use Empyrical

ret = 0.072 0.0697 0.08 0.74 1.49 0.9 0.26 0.9 0.35 0.63 0.702 0.97 0.708 1.74 0.49 0.09 1.26 0.59 1.35 0.063

factorret = 0.702 0.97 0.708 1.74 0.49 0.09 1.26 0.59 1.35 0.063 0.072 0.0697 0.08 0.74 1.49 0.9 0.26 0.9 0.35 0.63

symbol = take(`F,10) join take(`GPRO,10)

date = (2022.03.02 + 0..4 join 7..11).take(20)

t = table(symbol as sym, date as dt, ret, factorret)

select sym,alphaBeta(ret, factorret) as `alpha`beta from t context by sym

/*

sym alpha beta

---- -------------------- ------------------

F 2.936093190579921E62 -0.276883617899559

F 2.936093190579921E62 -0.276883617899559

...

*/3. Function Performance Evaluation

This section uses the rollSharpeRatio function as an example to

conduct a performance comparison of direct function call, and also provides the

performance comparison of all functions in grouped use in SQL statements using real

daily stock return data.

3.1 Direct Function Call

use Empyrical

ret= 0.072 0.0697 0.08 0.74 1.49 0.9 0.26 0.9 0.35 0.63

ret = take(ret, 10000000)

timer x = rollSharpeRatio(ret, windows =10)Applying the rollSharpeRatio function from the Empyrical module

directly on a vector of length 10,000,000 took 300.135 ms.

The corresponding Python code is as follows:

import numpy as np

import empyrical as em

import time

ret = np.array([0.072, 0.0697, 0.08, 0.74, 1.49, 0.9, 0.26, 0.9, 0.35, 0.63])

ret = np.tile(ret,10000000)

start_time = time.time()

x = em.roll_sharpe_ratio(ret, 10)

print("--- %s seconds ---" % (time.time() - start_time))The roll_sharpe_ratio function from the Python Empyrical library

took 25,965.46 ms, which is 86 times longer than the

rollSharpeRatio function in the DolphinDB Empyrical

module.

3.2 Grouped Calculation in SQL Statements

The performance test data consists of daily return data for all stocks in market

from January 3, 2019, to July 1, 2022, along with simulated factor data and

portfolio weights (for testing computeExposure and

perfAttrib functions), totaling 3,452,106 records. Sample

data from the test files are provided in the appendix. After extraction, place

them under the [home] directory.

The computation logic involves grouping by stock code to calculate each metric. To evaluate the function performance, both the DolphinDB and Python test codes are executed in single-threaded mode.

The test result is as shown in the table:

| No. | Function | DolphinDB Time | Python Time | Python/DolphinDB |

|---|---|---|---|---|

| 1 | simpleReturns | 190.7 ms | 5,871.1ms | 30.78 |

| 2 | aggregateReturns | 238.5 ms | 11,167.8 ms | 46.83 |

| 3 | annualReturns | 66.8 ms | 889.1ms | 13.30 |

| 4 | cumReturns | 84.7 ms | 2,758.7ms | 32.56 |

| 5 | cumReturnsFinal | 82.4 ms | 835.4ms | 10.13 |

| 6 | alpha | 131.2 ms | 6,910.7 ms | 52.67 |

| 7 | rollAlpha | 548.1 ms | 5,143.4 ms | 9.38 |

| 8 | covarBeta | 84.3ms | 5,422.9 ms | 64.32 |

| 9 | rollCovarBeta | 195.9 ms | 4,306.8 ms | 21.98 |

| 10 | alphaBeta | 112.5 ms | 6,929.8 ms | 61.59 |

| 11 | rollAlphaBeta | 547.7 ms | 8,676.7 ms | 15.84 |

| 12 | upAlphaBeta | 156.1 ms | 5,653.1 ms | 36.21 |

| 13 | downAlphaBeta | 148.6 ms | 5,722.9 ms | 38.52 |

| 14 | betaFragilityHeuristic | 262.7 ms | 12,906.5 ms | 49.14 |

| 15 | annualVolatility | 64.5 ms | 776.5 ms | 12.03 |

| 16 | rollAnnualVolatility | 136.9 ms | 2,869.9 ms | 20.96 |

| 17 | downsideRisk | 137.3 ms | 679.0 ms | 4.94 |

| 18 | hisValueAtRisk | 152.9 ms | 710.3 ms | 4.64 |

| 19 | conditionalValueAtRisk | 155.8 ms | 306.2 ms | 1.97 |

| 20 | gpdRiskEstimates | 7.3s | 26.4s | 3.61 |

| 21 | tailRatio | 235.4 ms | 1,224.2 ms | 5.20 |

| 22 | capture | 103.7 ms | 2,343.0 ms | 22.59 |

| 23 | upCapture | 165.7 ms | 4,284.7 ms | 25.69 |

| 24 | downCapture | 165.6 ms | 4,254.3 ms | 25.85 |

| 25 | upDownCapture | 232.8 ms | 7,380.0 ms | 31.70 |

| 26 | rollUpCapture | 30.1 s | 2,204.8 s | 73.33 |

| 27 | rollDownCapture | 30.4 s | 2,195.3 s | 72.32 |

| 28 | rollUpDownCapture | 53.7 s | 4,146.4 s | 77.20 |

| 29 | omegaRatio | 111.6 ms | 3,946.0 ms | 35.37 |

| 30 | cumMaxDrawdown | 99.4 ms | 500.3ms | 5.03 |

| 31 | rollCumMaxDrawdown | 1.4s | 3.1s | 2.11 |

| 32 | calmarRatio | 118.3 ms | 1,338.4 ms | 11.32 |

| 33 | sharpeRatio | 100.6 ms | 974.7 ms | 9.68 |

| 34 | rollSharpeRatio | 160.7 ms | 3,277.3 ms | 20.39 |

| 35 | excessSharpe | 103.6 ms | 2,828.9 ms | 27.31 |

| 36 | sortinoRatio | 180.5 ms | 988.8 ms | 5.47 |

| 37 | rollSortinoRatio | 287.0 ms | 3,160.3 ms | 11.01 |

| 38 | stabilityOfTimeseries | 365.5 ms | 1,707.9 ms | 4.67 |

| 39 | computeExposure | 183.6 ms | 256.5 ms | 1.39 |

| 40 | perfAttrib | 251.9 ms | 3,484.8 ms | 13.83 |

The test results show that the function performance of the DolphinDB Empyrical module surpasses that of the Python Empyrical library in most cases, with the maximum performance gap reaching 70 times, and an average gap of around 9 times.

Python pandas test code:

grouped = returns.groupby('SecurityID')

cum_returns = grouped['ret'].apply(lambda x: em.cum_returns(x))DolphinDB test code:

cumReturns =

select SecurityID, DateTime, cumReturns(ret) as cumReturns

from returns

context by SecurityID4. Consistency Verification

Based on the test data and code used in the performance comparison for grouped calculation, we also verify whether the calculation results of functions in the DolphinDB Empyrical module are consistent with those in the Python Empyrical library.

4.1 Handling of Null Values

If the input vector in Python Empyrical contains null values, the nulls are passed into the function and included in the calculation. The Empyrical module adopts the same strategy. The results produced by DolphinDB Empyrical are closely aligned with those of the Python Empyrical library, with only minor differences due to floating-point precision.

Note: While DolphinDB retains null values at the first (k–1) positions for strict window alignment, the Python Empyrical library skips initial nan values and begins computation as soon as a valid window is available.

DolphinDB Example

ret = NULL NULL 0.08 0.74 1.49 0.9 0.26 0.9 0.35 0.63 0.702 0.97 0.708 1.74

0.49 0.09 1.26 0.59 1.35 0.063

rollAnnualVolatility(ret, windows =10)

/*

[,,,,,,,,,7.107626186006128,6.650903096572676,6.445987651244765,5.4412961691126505,

7.3080574710383885,6.603612950499143,7.349681897878303,7.448075187590415,

7.475411961892134,7.649430305584855,8.584637604465316]

*/Python Example

ret = np.array([np.nan, np.nan, 0.08, 0.74, 1.49, 0.9, 0.26,

0.9, 0.35, 0.63, 0.702, 0.97, 0.708, 1.74, 0.49, 0.09, 1.26, 0.59, 1.35, 0.063])

print(em.roll_annual_volatility(ret,10))

/*

[7.10762619 6.6509031 6.44598765 5.44129617 7.30805747 6.60361295

7.3496819 7.44807519 7.47541196 7.64943031 8.5846376 ]

*/4.2 Optimized Output Format

The following functions generate different results from Python:

alphaBeta, upAlphaBeta,

downAlphaBeta, gpdRiskEstimates.

In Python Empyrical, the results of alphaBeta,

upAlphaBeta, and downAlphaBeta combine

alpha and beta into a two-dimensional array, requiring further post-processing.

In DolphinDB, alpha and beta can be directly separated into two columns using SQL query statements.

select SecurityID, alphaBeta(ret, factorRet) as `alpha`beta

from return1

group by SecurityID

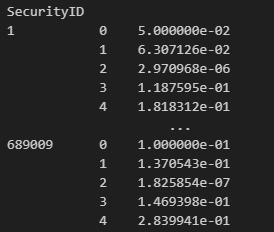

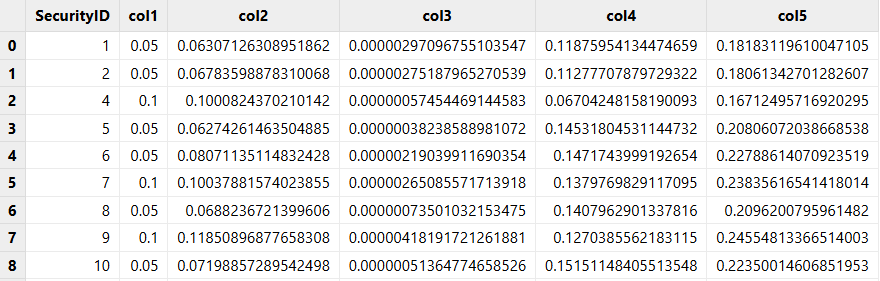

While for the function gpdRiskEstimates, all the estimates are

output in one column in Python:

In DolphinDB, the estimates are displayed in separate columns:

5. Real-Time Stream Processing

Most functions in the Empyrical module can be used in the reactive state engine as metrics for real-time incremental calculation. For example:

// clean environment

def cleanEnvironment(){

try{ unsubscribeTable(tableName="inputTable",actionName="calculateEmpyrical") }

catch(ex){ print(ex) }

try{ dropStreamEngine("EmpyricalReactiveSateEngine") } catch(ex){ print(ex) }

try{ dropStreamTable(`inputTable) } catch(ex){ print(ex) }

try{ dropStreamTable(`outputTable) } catch(ex){ print(ex) }

undef all

}

cleanEnvironment()

go

// load module

use Empyrical

// load data

schema = table(`DateTime`SecurityID`ret`factor2`factor1`factor3`position as name,

`DATE`SYMBOL`DOUBLE`DOUBLE`DOUBLE`DOUBLE`DOUBLE as type)

data=loadText(<YOUR_DIR>+"factors_data.csv" ,schema=schema)

// define stream table

share streamTable(1:0, `DateTime`SecurityID`ret`factor2`factor1`factor3`position,

`DATE`SYMBOL`DOUBLE`DOUBLE`DOUBLE`DOUBLE`DOUBLE) as inputTable

share streamTable(1:0,`SecurityID`DateTime`sortinoRatio`annualVolatility`sharpeRatio,

`SYMBOL`DATE`DOUBLE`DOUBLE`DOUBLE) as outputTable

// register stream computing engine

reactiveStateMetrics=<[

DateTime,

Empyrical::rollAnnualVolatility(ret) as `sortinoRatio,

Empyrical::rollSharpeRatio(ret) as `annualVolatility,

Empyrical::rollSortinoRatio(ret) as `sharpeRatio

]>

createReactiveStateEngine(name="EmpyricalReactiveSateEngine",

metrics=reactiveStateMetrics, dummyTable=inputTable, outputTable=outputTable,

keyColumn=`SecurityID, keepOrder=true)

subscribeTable(tableName="inputTable", actionName="calculateEmpyrical",

offset=-1, handler=getStreamEngine("EmpyricalReactiveSateEngine"),

msgAsTable=true, reconnect=true)

// replay data

submitJob("replay","replay",replay{data,inputTable,`tradedate,`tradedate,1000,true})6. Empyrical Function Reference

6.1 Returns

| Function | Syntax | Description |

|---|---|---|

| simpleReturns | simpleReturns(prices) | Simple returns |

| aggregateReturns | aggregateReturns(returns,date, convertTo='yearly') | Aggregate returns by week, month, or year |

| annualReturns | annualReturn(returns, period="daily", annualization=NULL) | Compound annual growth rate (CAGR) |

| cumReturns | cumReturns(returns, startingValue=0) | Cumulative simple returns |

| cumReturnsFinal | cumReturnsFinal(returns, startingValue=0) | Total simple returns |

6.2 Alpha & Beta

| Function | Syntax | Description |

|---|---|---|

| alpha | alpha(returns, factorReturns, riskFree=0.0, period="daily", annualization=NULL, beta=NULL) | Annualized alpha |

| rollAlpha | rollAlpha(returns, factorReturns, riskFree=0.0, period="daily", annualization=NULL, windows = 10) | Rolling window alpha |

| covarBeta | covarBeta(returns, factorReturns, riskFree=0.0) | Beta value |

| rollCovarBeta | rollCovarBeta(returns, factorReturns, riskFree=0.0, windows = 10) | Rolling window beta |

| alphaBeta | alphaBeta(returns, factorReturns, riskFree=0.0, period="daily", annualization=NULL) | Annualized alpha and beta |

| rollAlphaBeta | rollAlphaBeta(returns, factorReturns, riskFree=0.0, period="daily", annualization=NULL, windows=10) | Rolling window alpha and beta |

| upAlphaBeta | upAlphaBeta(returns, factorReturns, riskFree=0.0, period="daily", annualization=NULL) | Alpha and beta during periods of positive benchmark returns |

| downAlphaBeta | downAlphaBeta(returns, factorReturns, riskFree=0.0, period="daily", annualization=NULL) | Alpha and beta during periods of negative benchmark returns |

| betaFragilityHeuristic | betaFragilityHeuristic(returns, factorReturns) | Estimate fragility when beta declines |

6.3 Risk Management

| Function | Syntax | Description |

|---|---|---|

| annualVolatility | annualVolatility(returns, period="daily", annualization=NULL, alpha=2.0) | Annualized volatility |

| rollAnnualVolatility | rollAnnualVolatility(returns, period="daily", annualization=NULL, windows=10, alpha=2.0) | Rolling window annualized volatility |

| downsideRisk | downsideRisk(returns, requiredReturn=0.0, period="daily", annualization=NULL) | Downside deviation below a threshold |

| hisValueAtRisk | valueAtRisk(returns, cutoff=0.05) | Value at risk (VaR) |

| conditionalValueAtRisk | conditionalValueAtRisk(returns, cutoff=0.05) | Conditional value at risk (CVaR) |

| gpdRiskEstimates | gpdRiskEstimates(returns, varP=0.01) | Estimate VaR and ES using generalized pareto distribution (GPD) |

| tailRatio | tailRatio(returns) | Ratio between the right tail (95%) and the left tail (5%) |

6.4 Capture Ratio

| Function | Syntax | Description |

|---|---|---|

| capture | capture(returns, factorReturns, period="daily", annualization=NULL) | Capture ratio |

| upCapture | upCapture(returns, factorReturns, period="daily", annualization=NULL) | Up capture ratio during periods of positive benchmark returns |

| downCapture | downCapture(returns, factorReturns, period="daily", annualization=NULL) | Up capture ratio during periods of negative benchmark returns |

| upDownCapture | upDownCapture(returns, factorReturns, period="daily", annualization=NULL) | Ratio of up capture to down capture |

| rollUpCapture | rollUpCapture(returns, factorReturns, windows=10, period="daily", annualization=NULL) | Rolling up capture ratio |

| rollDownCapture | rollDownCapture(returns, factorReturns, windows=10, period="daily", annualization=NULL) | Rolling down capture ratio |

| rollUpDownCapture | rollUpDownCapture(returns, factorReturns, windows=10, period="daily", annualization=NULL) | Ratio of rolling up capture to rolling down capture |

6.5 Risk-Adjusted Returns

| Function | Syntax | Description |

|---|---|---|

| omegaRatio | omegaRatio(returns, period="daily", riskFree=0.0, requiredReturn=0.0, annualization=NULL) | Omega ratio |

| cumMaxDrawdown | maxdrawdown(returns) | Maximum drawdown |

| rollCumMaxDrawdown | rollCumMaxDrawdown(returns, windows = 10) | Rolling window maximum drawdown |

| calmarRatio | calmarRatio(returns, period="daily", annualization=NULL) | Calmar ratio of the strategy, i.e., drawdown ratio |

| sharpeRatio | sharpeRatio(returns, riskFree=0.0, period="daily", annualization=NULL) | Sharpe ratio |

| rollSharpeRatio | rollSharpeRatio(returns, riskFree=0.0, period="daily", annualization=NULL, windows=10) | Rolling Sharpe ratio |

| excessSharpe | excessSharpe(returns, factorReturns) | Excess Sharpe ratio |

| sortinoRatio | sortinoRatio(returns, requiredReturn=0.0, period="daily", annualization=NULL) | Sortino ratio |

| rollSortinoRatio | rollSortinoRatio(returns, requiredReturn=0.0, period="daily", annualization=NULL, windows=10) | Rolling Sortino ratio |

6.6 Return Stability and Performance Attribution

| Function | Syntax | Description |

|---|---|---|

| stabilityOfTimeseries | stabilityOfTimeseries(returns) | R² of the linear fit to cumulative log returns |

| computeExposure | computeExposures( factorLoadings, factorColumns=`factor1`factor2`factor3, positionName=`position`position`position, dtName=`DateTime) | Daily risk factor exposures |

| perfAttrib | perfAttrib(returns, factorReturns, factorLoadings, factorColumns=`factor1`factor2`factor3, positionName=`position`position`position, dtName=`DateTime) | Performance attribution (attributing investment returns to a set of risk factors) |